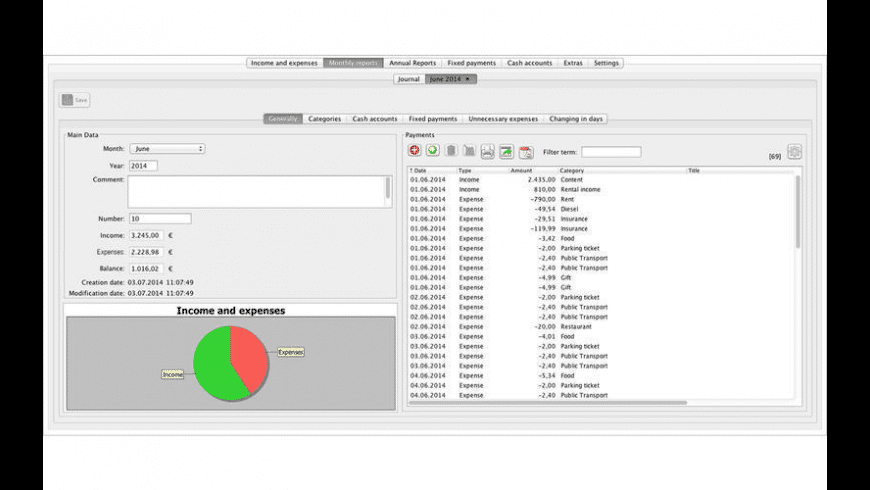

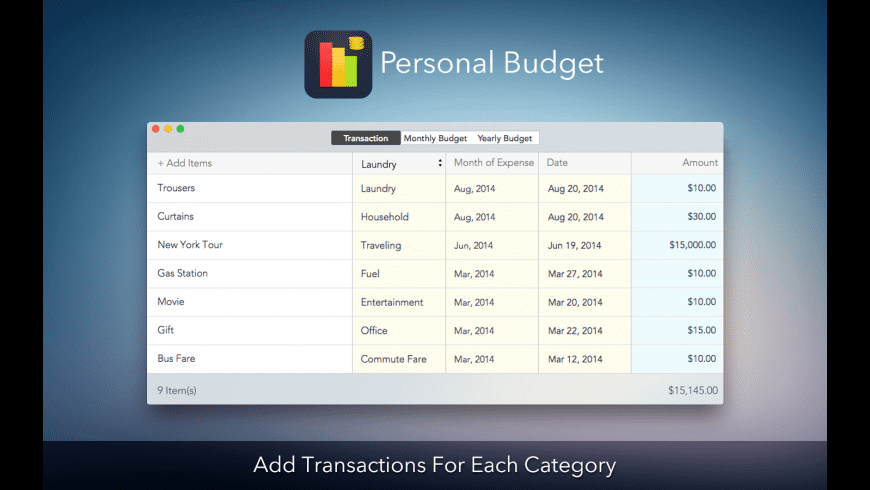

May 23, 2020 Budget 6.8.2 for Mac is free to download from our software library. This app's bundle is identified as com.RonAndKyle.Budget. This program was developed to work on Mac OS X 10.5.0 or later. The software lies within Lifestyle Tools, more precisely Bookkeeping & Cataloging. 6 of the best budget monitors for your Mac. By Ian Osborne (MacFormat Issue 213) 15 October 2009. Your Mac Pro or Mac mini needs a screen, but which one? While budgeting apps and software are popular, you don't need anything more than a pen and some paper to write a budget. 'To get started, you need to write down all of your expenses, from your.

A lot of people wonder how much of their income they should spend on their home, vehicle, groceries, clothes, etc. Below are some guidelines to give you a general idea and provide you with a starting point for your budget. Based on your income, family circumstances, and the part of the country you live in, your allocations may be very different.

To work with these budgeting guidelines, begin by developing your budget with the money you have available after government deductions from your pay cheque, but before voluntary deductions such as RRSPs, pensions, or other savings. If you have expenses such as high debt payments, childcare, school expenses, or giving, you will need to reduce your spending in other areas to allow for these higher expenses.

Breakdown of Cost of Living Budgeting Categories

- Housing: 35%

mortgage / taxes / strata / rent/ insurance / hydro - Utilities: 5%

phone / cell phone / gas / cable / internet - Food: 10 – 20%

groceries / personal care / baby needs - Transportation: 15 – 20%

bus / taxi / fuel / insurance / maintenance / parking - Clothing: 3 – 5%

for all members of the family - Medical: 3%

health care premiums / specialists / over-the-counter - Personal & Discretionary: 5 – 10%

entertainment / recreation / education / tobacco/alcohol / eating out / gaming / hair cuts / hobbies - Savings: 5 – 10%

Plan to save money for expenses that don’t occur every month, as well as for your future. Then you’ll have a little extra available when you need it. - Debt Payments: 5 – 15%

Many people find that their budget is quite tight when their monthly debt payments are close to 23% of their net income.

How to View These Budgeting Guidelines

These guidelines have been created for someone who really needs to put together a tight budget. If finances aren't strained in your household, you can decide to be more relaxed and go beyond the guidelines in areas as long as you're doing two things: 1) you're not spending more than you earn, and 2) you're allocating some money towards savings (savings are absolutely necessary for life's many unexpected expenses. Don't rely on credit for these unexpected expenses. Rely on money you've saved).

The category in these guidelines that people will most commonly exceed is the Personal & Discretionary expense category. The guidelines suggest you spend 5 - 10% of your income in this category. However, if you happen to have young children in daycare, have high education costs, take nice vacations, tithe, or have hobbies or recreational interests that aren't cheap, you'll quickly exceed the suggested maximum for this category. Please know there is nothing wrong with exceeding this limit as long as your budget balances (your expenses don't exceed your income).

You may also notice that if you spend the maximum amount in every category, you'll exceed 100% of your income. These guidelines are only recommended ranges. Life is all about choices, but you can't choose the maximum amount in all spending categories. Spending more in one category may mean that you'll have to cut back in another category to make your budget balance. If you live in Canada's far north or in a city where homes are very expensive, you may have to cut back more than an average Canadian would in certain categories in order to afford your higher living costs. In these cases, you will most likely exceed the suggested maximum guidelines for Food or Housing.

The Easiest Way to Use The Guidelines

To make budgeting easier, we've built these budgeting guidelines into an Excel Budgeting Calculator Spreadsheet provided through our educational website, MyMoneyCoach.ca.

As you enter your living expenses, the interactive spreadsheet will calculate all the spending guideline numbers for you. It also visually compares your spending in each category to these guidelines so that you can see how you're doing. As you fill out the budget spreadsheet with your living expenses, it warns you if you are exceeding the guidelines in any area of your budget, and visually shows you how your spending falls into these guidelines. It basically guides you through the process of creating a budget and suggests spending amounts for every budgeting category listed above based on your income and family size. When you're done, it also shows you what your budget looks like in a pie chart divided into the various expense categories.

On top of all this, the budgeting calculator offers you tons of helpful suggestions and tips along the way, so that you can avoid the common pitfalls of the budgeting process.

Check out the Budget Calculator for yourself! It's free and easy to use - even if you've never used Excel before. You can also download it for the Mac or OpenOffice (free open source office software) if you don't have Excel on your computer.

A lot of people wonder how much of their income they should spend on their home, vehicle, groceries, clothes, etc. Below are some guidelines to give you a general idea and provide you with a starting point for your budget. Based on your income, family circumstances, and the part of the country you live in, your allocations may be very different.

To work with these budgeting guidelines, begin by developing your budget with the money you have available after government deductions from your pay cheque, but before voluntary deductions such as RRSPs, pensions, or other savings. If you have expenses such as high debt payments, childcare, school expenses, or giving, you will need to reduce your spending in other areas to allow for these higher expenses.

Breakdown of Cost of Living Budgeting Categories

- Housing: 35%

mortgage / taxes / strata / rent/ insurance / hydro - Utilities: 5%

phone / cell phone / gas / cable / internet - Food: 10 – 20%

groceries / personal care / baby needs - Transportation: 15 – 20%

bus / taxi / fuel / insurance / maintenance / parking - Clothing: 3 – 5%

for all members of the family - Medical: 3%

health care premiums / specialists / over-the-counter - Personal & Discretionary: 5 – 10%

entertainment / recreation / education / tobacco/alcohol / eating out / gaming / hair cuts / hobbies - Savings: 5 – 10%

Plan to save money for expenses that don’t occur every month, as well as for your future. Then you’ll have a little extra available when you need it. - Debt Payments: 5 – 15%

Many people find that their budget is quite tight when their monthly debt payments are close to 23% of their net income.

How to View These Budgeting Guidelines

Budgets For Married Couples

These guidelines have been created for someone who really needs to put together a tight budget. If finances aren't strained in your household, you can decide to be more relaxed and go beyond the guidelines in areas as long as you're doing two things: 1) you're not spending more than you earn, and 2) you're allocating some money towards savings (savings are absolutely necessary for life's many unexpected expenses. Don't rely on credit for these unexpected expenses. Rely on money you've saved).

The category in these guidelines that people will most commonly exceed is the Personal & Discretionary expense category. The guidelines suggest you spend 5 - 10% of your income in this category. However, if you happen to have young children in daycare, have high education costs, take nice vacations, tithe, or have hobbies or recreational interests that aren't cheap, you'll quickly exceed the suggested maximum for this category. Please know there is nothing wrong with exceeding this limit as long as your budget balances (your expenses don't exceed your income).

You may also notice that if you spend the maximum amount in every category, you'll exceed 100% of your income. These guidelines are only recommended ranges. Life is all about choices, but you can't choose the maximum amount in all spending categories. Spending more in one category may mean that you'll have to cut back in another category to make your budget balance. If you live in Canada's far north or in a city where homes are very expensive, you may have to cut back more than an average Canadian would in certain categories in order to afford your higher living costs. In these cases, you will most likely exceed the suggested maximum guidelines for Food or Housing.

The Easiest Way to Use The Guidelines

To make budgeting easier, we've built these budgeting guidelines into an Excel Budgeting Calculator Spreadsheet provided through our educational website, MyMoneyCoach.ca.

As you enter your living expenses, the interactive spreadsheet will calculate all the spending guideline numbers for you. It also visually compares your spending in each category to these guidelines so that you can see how you're doing. As you fill out the budget spreadsheet with your living expenses, it warns you if you are exceeding the guidelines in any area of your budget, and visually shows you how your spending falls into these guidelines. It basically guides you through the process of creating a budget and suggests spending amounts for every budgeting category listed above based on your income and family size. When you're done, it also shows you what your budget looks like in a pie chart divided into the various expense categories.

Budget Software Free

On top of all this, the budgeting calculator offers you tons of helpful suggestions and tips along the way, so that you can avoid the common pitfalls of the budgeting process.

Excel Budgets For Mac

Check out the Budget Calculator for yourself! It's free and easy to use - even if you've never used Excel before. You can also download it for the Mac or OpenOffice (free open source office software) if you don't have Excel on your computer.